Scaling from research to reality: How CFS is building a colossal fusion future

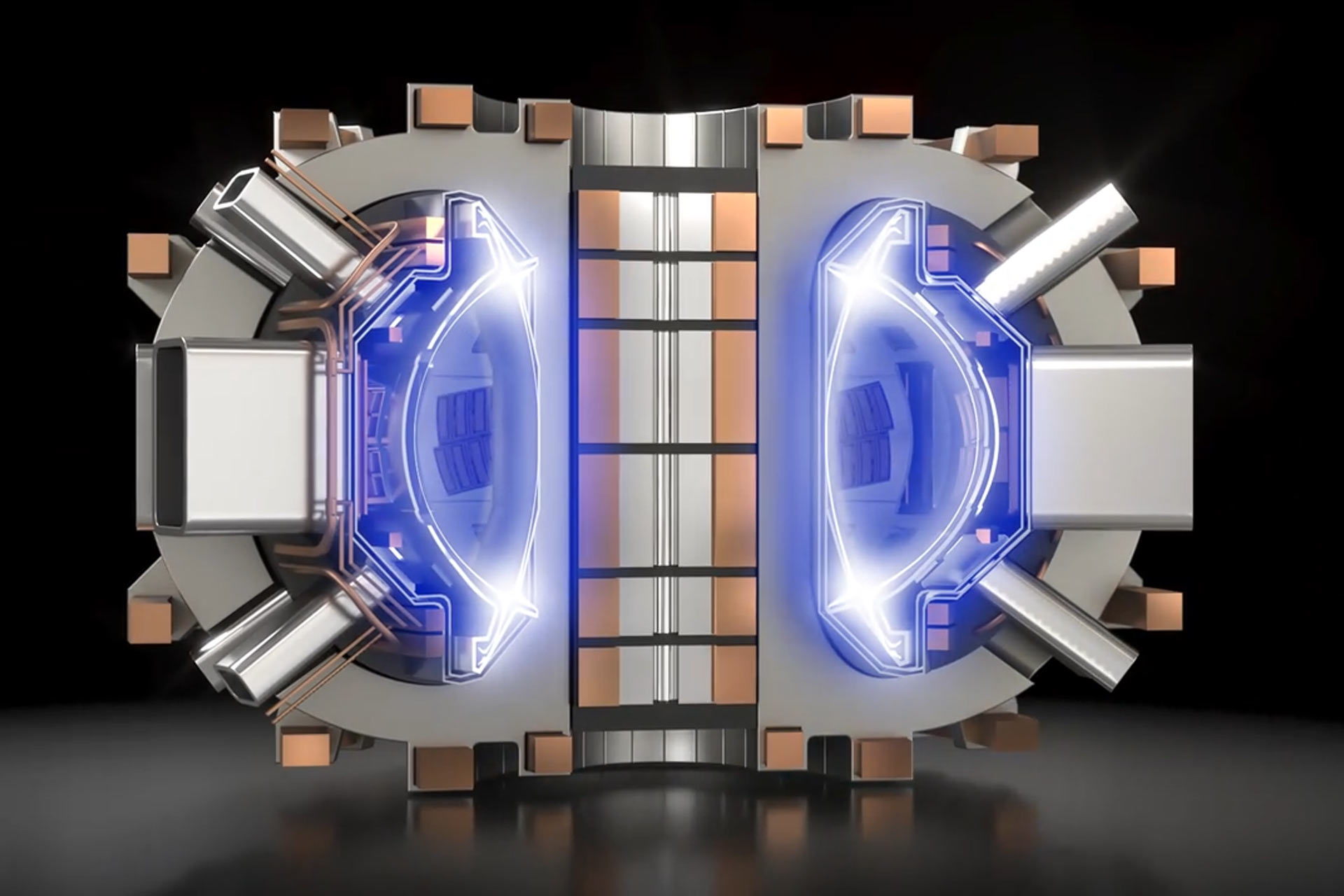

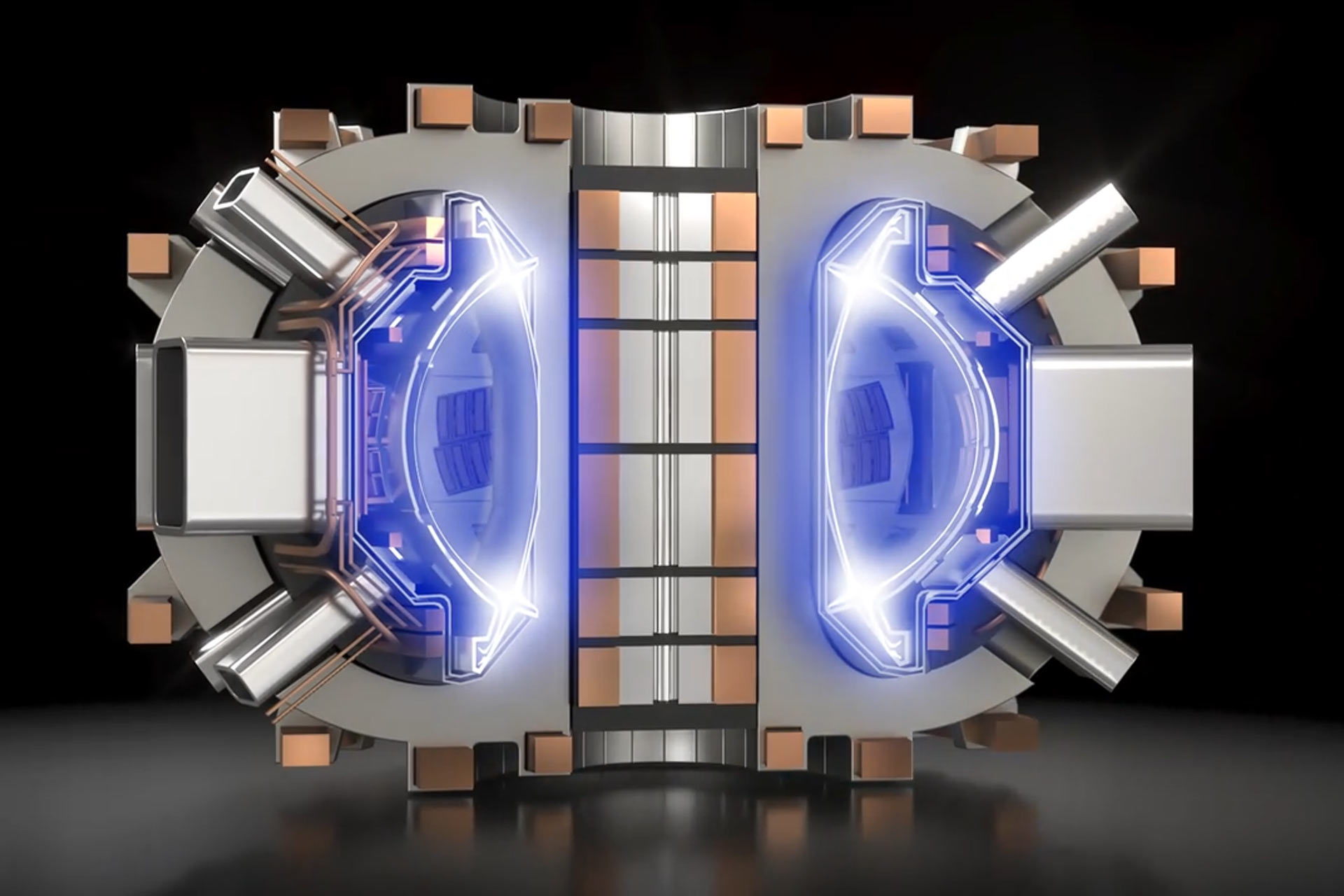

One of Commonwealth Fusion Systems’ audacious goals is to rapidly commercialize our ARC fusion power plants, putting thousands on the grid by 2050. But how do we actually get there?

In short, we’ve got to scale up rapidly, making the transition from proving first-of-a-kind technologies to mass manufacturing. It’ll be hard work, but it’s been done before with solar, wind, fission, and coal power. Fusion, with no fundamental resource limits, is the technology we need to take to the finish line.

Here’s a look at how our plan plays out, including the big-picture plan to make many power plants and the business climate that’s already pulling those plants onto the grid. This is the CFS future that extends beyond our first tokamak, SPARC, to the ARC power plant era that’ll help fight climate change and supply the clean, abundant, reliable power the world needs.

To chart our course to 2050, we look at related efforts that have yielded results that bear on our own challenge. For example, Tesla grew its auto manufacturing rate by 100%, doubling its output in just one year. In World War II, U.S. airplane manufacturing grew even faster at 120% annually.

Once fusion starts to scale and mature, it’ll start looking like the obvious choice for power, propelling its growth. Expanding from one power plant to 10,000 over two decades requires a 50% annual growth rate. That’s why we have such a focus on accelerating manufacturing even today. Making more stuff means we learn how to make it faster and cheaper.

“You have to start somewhere,” CFS Chief Executive and Co-Founder Bob Mumgaard says. “You get better and better at it, and eventually it feels inevitable.”

It’s a big business. Today, about 3,700 power plants supply at least 400 megawatts, the power range our ARC systems are designed to produce. Collectively, those 3,700 plants supply 86% of the world’s power, which at a rate of $80 per megawatt-hour means annual revenue of about $1.8 trillion per year. As the energy transition progresses, power use is expected to increase by a factor of 1.5x to 3x by 2050.

Many of those 3,700 plants are fossil-fueled facilities that’ll be retired. The need for their reliable power won’t go away, though. On the contrary, we’ll need firm power even more as inexpensive but variable solar and wind expand on the grid.

“As electricity generation from intermittent renewables increases, the timing imbalance between peak customer demand and renewable energy production is exacerbated,” financial advisory and asset management firm Lazard reports in its June energy cost analysis. The fix: complementing today’s renewable technology with “firming” technology to ensure a reliable supply.

That’s a job where fusion can help. And with our siting flexibility, our fusion plants can be located closer to where customers need power. We can even drop in “behind the meter” to give customers power plants that avoid peak-hour price hikes, improve reliability, and don’t need new transmission lines.

Compare our flexibility to that of the largest solar plant today. It peaks at 5 gigawatts of power generation, but at 312 square miles occupies more land than all five of New York City’s boroughs. We’d need 13 ARCs to supply that much power from vastly less real estate — and our power plants work around the clock. Microsoft co-founder and CFS investor Bill Gates agrees. “In the long run, nuclear fusion will be, almost certainly, the primary source of electricity on the planet,” he says.

The biggest hurdle for getting new power generation technology to succeed is convincing the market that it’s worth investing in. Fusion’s timing is good, though. We’re experiencing market pull, not reluctance.

Customers include utilities that need to ramp up production during the energy transition and tech giants desperate for clean power to keep up with their data center growth. Many of those tech giants — hyperscalers, in industry jargon — are locked in a race to build the best AI.

Here’s why hyperscalers are good prospects:

That last point is key. Google’s goal is to use 24×7 zero-carbon power by 2030. There’s no hiding behind carbon offsets.

“The demand for clean energy has now morphed into the demand for clean, firm energy,” says CFS Chief Commercial Officer Rick Needham.

It’s a long-term plan. But we’re hard at work on it already.